The Growth of Grinding Machine Market and the Acceleration of Localization Process

Release time:

Jan 13,2025

As a key industrial manufacturing equipment, the design intention of grinding machines is to meet the needs of high-precision machining and hard material machining. With the continuous growth of market demand in key fields such as screw, titanium alloy, and silicon carbide, it is expected that this equipment will undergo significant capacity expansion and promote rapid improvement of domestic production capacity.

As a key industrial manufacturing equipment, the design intention of grinding machines is to meet the needs of high-precision machining and hard material machining. With the continuous growth of market demand in key fields such as screw, titanium alloy, and silicon carbide, it is expected that this equipment will undergo significant capacity expansion and promote rapid improvement of domestic production capacity.

What is a grinder?

As a key industrial infrastructure equipment, CNC grinding machines are crucial for grinding various materials and complex geometric shapes of parts, and their applications cover a wide range of downstream industries.

Grinding machine, a type of machine tool that uses abrasives and grinding tools (such as grinding wheels, sand belts, oilstones, abrasives) as tools, has been developed to meet the needs of high-precision and hard material processing. Among all machine tools, the precision requirements for grinding machines are extremely high, especially for ultra precision grinding machines, which pose the greatest technical challenges.

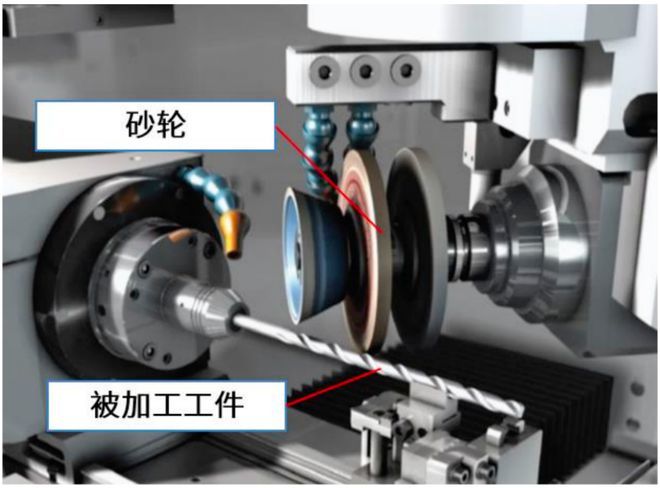

Grinding Processing Source: "Key Technologies and Research Status of Five Axis Linkage Tool Grinding Machines"

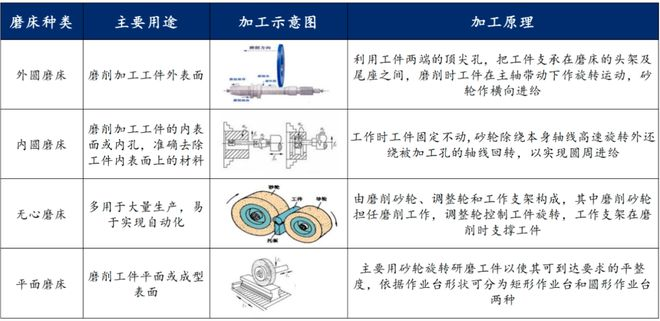

The grinding process is diversified according to the shape differences of the workpiece, among which external circular grinding, internal circular grinding, and flat grinding are the three most common. External cylindrical grinding is famous for its wide application, suitable for machining the outer surface of shaft and sleeve parts. Internal grinding, including center and planetary grinding, although has a similar feed method to external grinding, its technical difficulty is greater. Flat grinding focuses on the grinding of the surface of the workpiece, using grinding wheel flat or peripheral grinding technology.

Grinding tools, as indispensable consumables in grinding machine processing, including grinding wheels, grinding heads, oilstones, and sanding tiles, are grinding tools composed of abrasive grains, binders, and voids.

Source: Machine Tool Business Network

Numerical control grinders play a crucial role in manufacturing key industrial components such as engines and internal combustion engines. They are widely used not only in the automotive industry, but also in fields such as engineering machinery, railway vehicles, and shipbuilding, for processing core components such as crankshafts and piston rings.

In high-tech fields such as aerospace and defense industries, CNC grinding machines are crucial for the development of new materials and technologies, including crystals, ceramics, superhard materials, and special wear-resistant materials. Therefore, the demand for high-precision, intelligent, and innovative CNC grinding machines continues to grow in these fields.

Why bring up the grinder at this time?

With the increasing recognition of domestically manufactured high-end CNC grinders in the market, their overall competitiveness has significantly strengthened, and local brands are gradually emerging, indicating that the market share of domestically produced high-end CNC grinders will steadily increase.

China's manufacturing industry is undergoing a transformation from a "mass production country" to a "high-quality manufacturing country", and is expected to pursue more "high-end, high return" business models in the future, rather than the traditional "low profit, high sales" strategy. Meanwhile, the demand for advanced CNC grinding machines with precision, efficiency, and high added value is expected to continue to rise.

The strategic document "Made in China 2025" sets clear goals, that is, by 2025, the domestic market share of high-end CNC machine tools and infrastructure equipment should exceed 80%, and the market share of mid to high end functional components such as spindles, screws, and tracks should also reach 80%. At the same time, efforts should be made to make high-end CNC machine tools and basic manufacturing equipment as a whole enter the world's leading level.

Faced with Western countries, especially within the framework of the "Batumi List" to the "Wassenaar Arrangement", strict technological restrictions have been imposed on China. For example, high-end grinding machines imported from Japan must undergo strict inspection procedures and are subject to restrictions on use and transfer. With the tension in international relations, there seems to be an increasing trend of technological blockade against China's high-precision multi axis machine tools.

At present, countries such as Japan, the United States, and Germany occupy a leading position in the field of grinding machine technology. Their enterprises consolidate their market position through different market positioning strategies, such as "comprehensive coverage" (such as multiple grinding machine brands under PSS Group) or "focusing on segmented markets" (such as Mitsui Precision Machinery's leading position in the thread grinding machine market). However, from the perspective of technology and patents, Chinese companies are rapidly catching up.

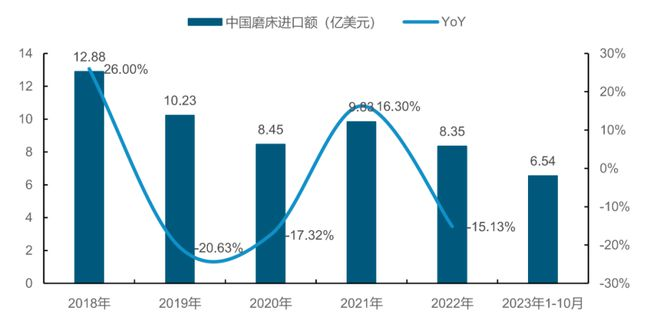

According to customs data, the import value of grinding machines in China once reached a peak of 1 billion US dollars. Although it has declined in recent years, the import value in 2022 still reached 835 million US dollars, showing great potential for import substitution. In addition, the average price of imported grinding machines is much higher than the export price. For example, in 2022, the average import price of CNC surface grinding machines was $183100, while the average export price was only $44400.

Source: General Administration of Customs, Wind

At present, the technological differences between domestically produced five axis tool grinders and similar foreign products have significantly narrowed. Industry experts predict that, driven by market demand, domestic grinders are expected to gradually replace imported products.

According to the analysis of the current status of patents and intellectual property rights in the field of composite grinding machines and machine tools, as of August 2020, China has a total of 14257 patents in the field of grinding machine technology, ranking first in the world.

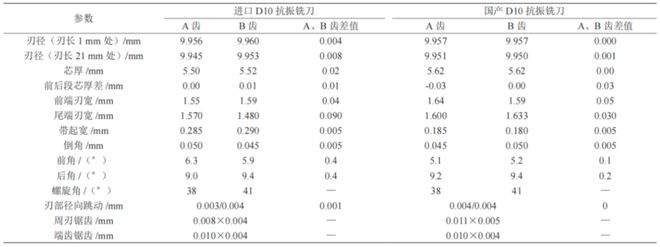

According to the case analysis in the report "Comparison Test of Machining Capability between Domestic and Imported Five Axis Tool Grinding Machines", both domestic and imported grinding machines have shown qualified machining parameters and good consistency in the performance comparison of machining D10 anti vibration milling cutters.

Especially in terms of the consistency of the blade diameter, core thickness, front and rear angles, and runout of the tested samples, the performance of domestic grinders is slightly better than that of imported grinders. Although there is a slight gap in the accuracy of clamping and outer diameter jumping between domestic grinders and imported grinders, the difference in product parameters produced by the two is not significant.

This indicates that the adjustment and control capabilities of domestic grinding machines in processing anti vibration milling cutters can meet industry standards and are comparable to the performance of imported grinding machines. This reflects that domestic grinding machines have made significant progress in technological accumulation and have the strength to compete with international brands.

Source: Comparative Test of Machining Capability between Domestic and Imported Five Axis Tool Grinding Machines

Multiple rounds of incremental demand continue to accelerate localization rate

According to statistics from the Machine Tool Industry Association, in 2022, the import value of grinding machines in China accounted for 12.2% of the total import value of metal processing machine tools. Given that grinding machines have a high proportion in imported machine tools and are mainly responsible for precision machining, we can assume that their proportion in metal processing machine tools is 8%. According to the estimation of the China Machine Tool Industry Association, the market consumption of metal processing machine tools in China in 2022 is RMB 184.36 billion, which is approximately USD 27.41 billion when converted into US dollars. Based on an 8% market share, the market potential for grinding machines is approximately 14.749 billion yuan.

At present, the three major fields of screw, titanium alloy, and silicon carbide are driving the growth of market demand.

In the manufacturing process of lead screws, preliminary machining can be carried out using methods such as grinding, hard turning, or whirlwind milling, while precision machining mainly relies on grinding technology, which accounts for nearly 40% of the entire machining time. Taking Qinchuan Machine Tool as an example, the investment in grinding machines accounts for nearly half of the investment in screw production line equipment. The manufacturing difficulty of screw mainly lies in the processing of the raceway, whether it is the nut or the screw shaft, thread processing is required. According to industry analysis, considering different processing times, the market space for grinding machines for 1 million humanoid robots may be between 2.2 to 4.4 billion yuan.

At present, industry-leading enterprises mainly rely on imported equipment from Japan and Germany in the field of screw grinders, such as the high-precision bed guide rail grinder purchased by Qinchuan Machine Tool, with a unit price of up to 28 million yuan.

On the one hand, domestic thread grinders have accumulated considerable technical strength. For example, the SK7420 model launched by Shanghai Machine Tool Factory in 2014 can already process P1 grade ball screw pairs, demonstrating that domestic enterprises have the ability to manufacture high-end thread grinders; On the other hand, the humanoid robot industry has high requirements for cost control of lead screws, and the demand for customized development and automation upgrades is also increasing. Domestic enterprises, as they are closer to end customers, are expected to seize the opportunity in this field. With the rapid growth of the humanoid robot industry, using domestic equipment to reduce costs has become a trend.

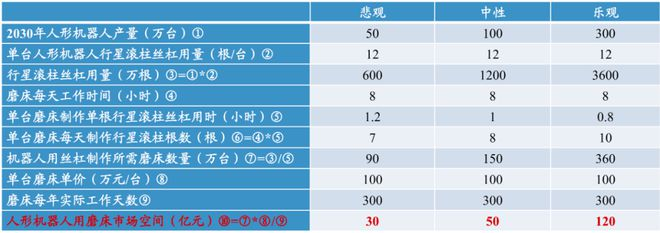

In the long run, if the production of humanoid robots rapidly increases, it may bring about a large demand for lead screws. According to the analysis and prediction of Dongwu Securities Research Institute, under the neutral assumption, the market space for planetary roller screw grinders used in humanoid robots may reach 5 billion yuan by 2030, demonstrating enormous market potential.

Data source: Rifa Precision Machinery official website, calculated by Dongwu Securities Research Institute

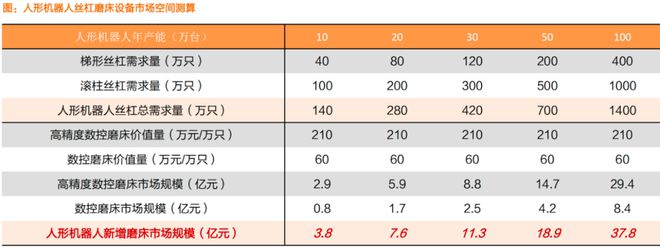

Tianfeng Securities Research Institute estimates that when the annual production capacity of humanoid robots reaches 1 million units, the corresponding market size of high-precision CNC grinders/CNC grinders is about 2.94/840 billion yuan, and it is expected that humanoid robots will bring a total of 3.78 billion yuan of incremental space to the grinder market.

Source: Qinchuan Machine Tool Announcement, Tianfeng Securities Research Institute

In the application field of titanium alloys, Apple has adopted titanium alloys in its mobile phones and watches, which has promoted the growth of demand for grinding and polishing equipment.

In consumer electronics manufacturing, grinding machines are widely used for polishing and polishing the glass screens, casings, and frames of smartphones and laptops. Given that Apple uses titanium alloy in its phones and watches, it is expected that other Android phone manufacturers will also begin using this type of material.

The processing challenges of titanium alloys are significant, such as high temperatures and wheel adhesion that may occur during the grinding process. This may require technological upgrades or replacements of existing grinding and polishing equipment, thereby stimulating the growth of the related equipment market.

Due to the low thermal conductivity, easy work hardening, strong affinity with tools, and small plastic deformation of titanium alloys, their processing difficulty is high, and the performance requirements for processing equipment are also increased accordingly. After rough machining of titanium alloys, grinding and polishing are usually required to improve the accuracy and surface smoothness of the product. The processing time of titanium alloy frames is about 3 to 4 times that of aluminum alloys. With the widespread application of titanium alloys in 3C electronic products, the demand for grinding equipment will also increase, and this trend is expected to continue.

In the field of silicon carbide, the steps involved in the preparation of silicon wafers, such as rolling, chamfering, grinding, and polishing, all require the use of grinding machines.

According to Wolfspeed's data, it is expected that the usage rate of silicon carbide in the automotive industry will significantly increase by 2027, with a market size expected to reach $4.986 billion and a compound annual growth rate of 39%. This will further drive the demand for related grinding and polishing equipment.

Related News